Gazing into the Deep Tech Crystal Ball: Investment Trends in 2020

Fri, 03/13/2020 - 12:00

Deep Tech has the potential to solve the world’s biggest societal issues. This has not gone unnoticed by nations – Singapore, for example, has injected an additional S$300 million into its Startup SG Equity scheme in its recent Budget 2020 announcement, to support the commercialisation of Deep Tech startups.

However, with multiple layers of technicalities and complexities involved, transformational Deep Tech can be a tricky venture for investors, especially non-tech ones, to get into.

While some practice the “spray and pray” approach by channelling funds into every technology company with hopes for one to become the next unicorn, the same approach might not be feasible for Deep Tech, given that larger, more “patient” capital is required.

But despite the challenges, Deep Tech can translate to impactful returns on a global scale. Here are some key trends on Deep Tech investing to get you started.

Love or Hate It, Artificial Intelligence is Here to Stay

AI has been trending on almost every investors’ list, so it’s unsurprising to see it remain a key investment area in 2020.

While AI has been touted as the be-all end-all technology of the future, it is still currently limited to managing simple, specific tasks. However, as we are still a distance from achieving ‘Artificial General Intelligence’ — the stage where machines can perform any tasks a human can — a safer bet would be to identify gaps that AI can plug in its current state of maturity.

For instance, AI companies in banking can resolve specific pain points, such as speeding up KYC (Know Your Customer) or AML (Anti-Money Laundering) processes.

The Re-Emergence of MedTech and AI in Healthcare

As societies struggle to cope with ageing population, demand for quality healthcare will continue to rise exponentially across the world. In fact, the Medical Technology (MedTech) market in Asia is poised to grow to about US$133 billion this year, surpassing the European Union as the second-largest market globally.

Lately, we are witnessing MedTech companies emerging from ‘stealth’ after years of undergoing proofs-of-concept and clinical trials. One of our portfolio companies, See-Mode, which helps clinicians improve prediction and assessment of stroke and vascular disease through AI, received a Class B medical device approval from the Singapore Health Sciences Authority for its Augmented Vascular Analysis product and is set to close its first commercial contracts.

In 2020, we expect more MedTech players coming to the fore, pushing out innovations with successful case studies and putting investment dollars to good use.

Cracking the Quantum Code

Quantum technology may sound like science fiction, but we believe that it is an inevitable technology. It has the potential to be a game-changer in a wide range of real-life applications — from superfast data processing and computing, defence and security, to managing energy use and production. Recognising this, nations and tech giants like Amazon, Microsoft, IBM and Google are pouring more money into this space.

This nascent sector is both new and expensive, making it difficult for investors to gauge the kind of returns they may see and when. Our view as investors in early-stage quantum companies is to identify those that create an environment which will make quantum computing more accessible to all. The hardware configuration of a general quantum computer is still the subject of debate so unless you have deep pockets, quantum may not be an area the average VC would want to consider.

Sowing the Seeds for Growth: AgriTech and FoodTech

As a result of climate change and the rapidly growing population, the world is set to face a 56 percent shortfall in food nutrition by 2050. For countries like Singapore, which relies on food imports, finding solutions towards self-sufficiency is critical.

Consumers are also becoming more socially conscious and selective in the food they consume, developing greater appetites for more sustainably produced foods.

These trends are driving demand, leading to greater investor interest in AgriTech and FoodTech startups. We foresee this to be an area of interest in the coming year.

On the Move with Autonomous Vehicles

Thanks to strong support from the Singapore government along its Smart Nation journey, development for autonomous vehicles (AVs) has shifted into gear in the last year with autonomous forklifts being tested in warehouses and autonomous trucks being trialled at the Port of Singapore.

However, there are still many technological, infrastructural (including insurance) and regulatory challenges to consider before we see mass deployment of true Level 5 vehicles. In the meantime, technologies that enhance existing sensors, energy storage, navigation and decision support — components essential for AVs — will offer startups a chance to monetise in the interim period before L5 vehicles hit the road.

These components can be deployed as part of existing vehicles and infrastructure, giving them an earlier time-to-market, while development of a full AV takes place in parallel.

Taking the Leap into Deep Tech Investing

Investing into Deep Tech is akin to investing into the future. Whether it’s in areas of sustainability, mobility or health, we believe that Deep Tech is the path towards solving some of mankind’s biggest challenges. The history of technology has proven that those willing to take the plunge early will reap the biggest rewards. That said, as pragmatic investors, we are highly selective as to what areas to place our bets in, as for a company to be able to go the distance till the category matures is perhaps more important than one with the brightest, shiniest technology.

Despite its challenges, Deep Tech is an investment territory with immense potential and opportunities. It’s time now to take the plunge, capitalise and harvest these opportunities to make a positive impact on the world.

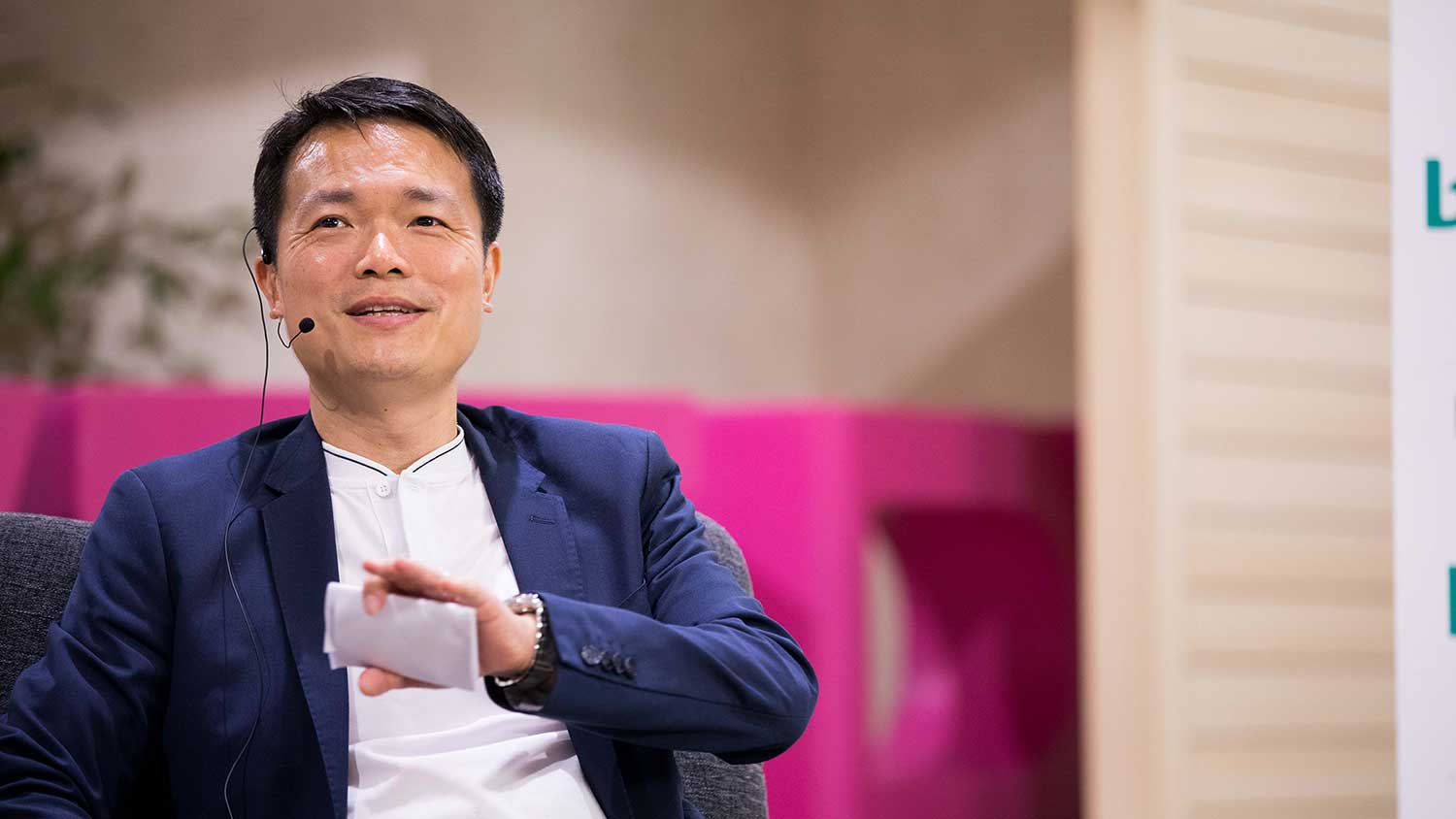

The author, Hsien-Hui Tong is Head of Venture Investing, SGInnovate. He oversees investment efforts which target high-potential, Deep Tech startups working on areas such as Artificial Intelligence, Autonomous Vehicles and MedTech.

Trending Posts

- From satellites to startups, Singapore’s space sector is pushing new frontiers

- How leaders should rethink cybersecurity strategy

- How to Future-Proof a Career in Deep Tech? Start here.

- The future of fusion energy: What will it take to bring the power of the stars to earth?

- Keeping satellites safe: How CYSAT Asia 2026 is tackling space cybersecurity